Thank you for visiting the Finch & Beak website. Finch & Beak is now part of SLR Consulting, a global organization that supports its clients on setting sustainability strategies and seeing them through to implementation.

This is an exciting time for us, as our team now includes an array of new colleagues who offer advisory and technical skills that are complementary to our own including Climate Resilience & Net Zero, Natural Capital & Biodiversity, Social & Community Impact, and Responsible Sourcing.

We would like to take this opportunity to invite you to check out the SLR website, so you can see the full potential of what we are now able to offer.

In response, companies and executives must develop a new sense of urgency, moving their sustainability programs from the realm of compliance and iterative improvements to that of a key driver of performance and innovation, which requires embedding it more deeply into their core strategies. Recent research from IMD business school proposes that companies implement a combination of direction and speed as already applied by sustainability champions such as Unilever, Umicore, DSM and Novozymes.

In the associated book encompassing the research, Winning Sustainability Strategies by IMD professor Benoit Leleux and Executive in Residence Jan van der Kaaij, the effective design and implementation of a stronger sense of focus, moving sustainability programs forward more rapidly, is dubbed Vectoring. It is analogous to the navigation service provided by an air traffic controller, whereby the controller decides on a particular path for the aircraft, composed of specific legs or vectors, which the pilot then follows. Sustainability programs that are looking for their North Star or Polaris, can lack air traffic controllers or often pilots for that matter.

The absence of directional bearings, or the selection of inadequate ones, lead to misguided, uncoordinated actions and usually unsatisfactory results from sustainability initiatives. To develop the concept of Vectoring, practitioner cases from sustainability leaders were examined in depth together with the anonymized results from ten selected industries in the Dow Jones Sustainability Index (DJSI) benchmark between 2015 to 2017 from automotive, banking, chemicals, construction materials, electric utilities, pharmaceuticals, food products, professional services, textiles and telecom.

Climate change is often portrayed as one of the most important and truly global material issues, with the potential to destruct entire nations, dramatically change agricultural practices or force massive migrations of people. With most, if not all, industries likely to be impacted by climate change, albeit to varying degrees, companies face the need to design appropriate strategies to tackle the challenge.

Investors are increasingly embedding this fact into their investment decisions. In 2016 BlackRock’s Scientific Active Equity (SAE) team found that U.S. companies with higher climate scores tend to be more profitable and generate higher returns on assets. Selecting a portfolio that was biased on CO2 performance, chosen from Russell 3000 Index companies, the weighted average of CO2 emissions came out almost 50% below the benchmark average. Financially, this same portfolio selection outperformed the Russell benchmark by seven percentage points.

The climate strategy criterion is one of more than 20 criteria that make up the full RobecoSAM assessment, making it one of the most comprehensive of its kind. Comparing the average score on climate strategy with the marks of the top decile performers over the three-year research period, demonstrates that sustainability leaders outperform industry averages by 16%.

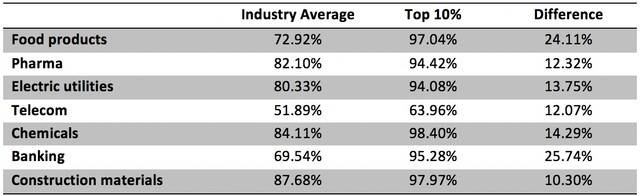

Table 1. Scoring on climate strategy criterion, 2015–2017 Dow Jones Sustainability Index, all companies, selected industries

Even more striking is the difference in performance when comparing the selected industries with each other; the scores of the highest-scoring industry (Construction Materials) and lowest-scoring industry (Telecom) differ 36%, on a topic that is recognized as being highly relevant for both industries.

While most companies look at the eminent risks associated with a changing climate, sustainability leaders were found to similarly seek and seize the business opportunities linked to this global challenge. In part this explains the striking score differences between those sustainability leaders and their sector average. With the investment community advancing their approaches for the valuation impact of non-financial ESG data, carbon pricing on the rise according to the World Bank and banks such as ING and DBS lining up to align their portfolio with the Paris Agreement 2 degrees scenario through sustainability-linked loans, companies are wise to rethink their approach to climate change and sustainability in general and capture the concept of “Vectoring”.

Winning Sustainability Strategies (Palgrave 2019, Leleux and Van der Kaaij) presents numerous award-winning cases from IMD business school and examples from companies such as Unilever, Torres, Patagonia, Tumi, DSM and Umicore alongside original ideas based upon 20 years of consulting experience. Based upon practitioner cases and data analysis from the Dow Jones Sustainability Index, the book offers practical suggestions for improved effectiveness of sustainability strategies. This includes designing and executing new sustainability programs, embedding the SDGs within company strategy and assessing the impact of sustainability programs on competitiveness and valuation. Offering directions for CFOs to shift companies from integrated reporting to integrated thinking in order to accelerate their sustainability programs, Winning Sustainability Strategies shows how to achieve purpose with profit and how to do well by doing good.

Finch & Beak

hello@finchandbeak.com

+34 627 788 170